The rise of biotechs is generating more and more heat-sensitive healthcare products

The 2000s have been marked by a period of global economic crisis and the emergence of generic laboratories. Consequently, pharmaceutical laboratories have been forced to review their strategy and from this point forward focus their research on healthcare products stemming from biotechnologies.

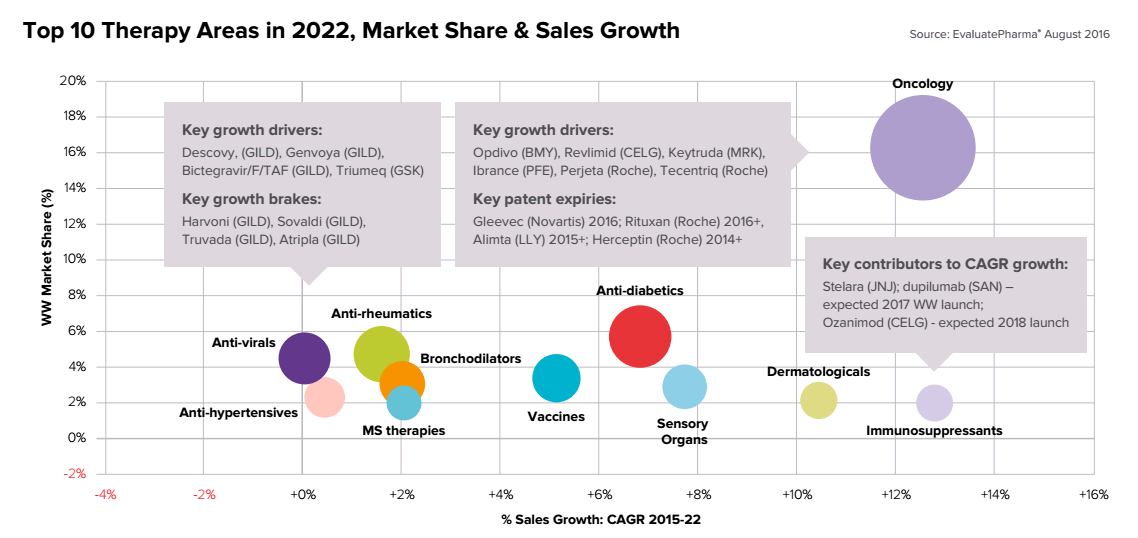

Although patents are more profitable, they are longer but their development is also much more expensive. The pharmaceutical companies are therefore developing innovative treatments stemming from biotechs, which respond to a growing demand for illnesses such as cancer or diabetes.

Top 10 therapeutic developments of pharmaceutical laboratories in 2022.

These medicines, originating from living cells are extremely sensitive to variations in temperature, with very little tolerance to fluctuations.

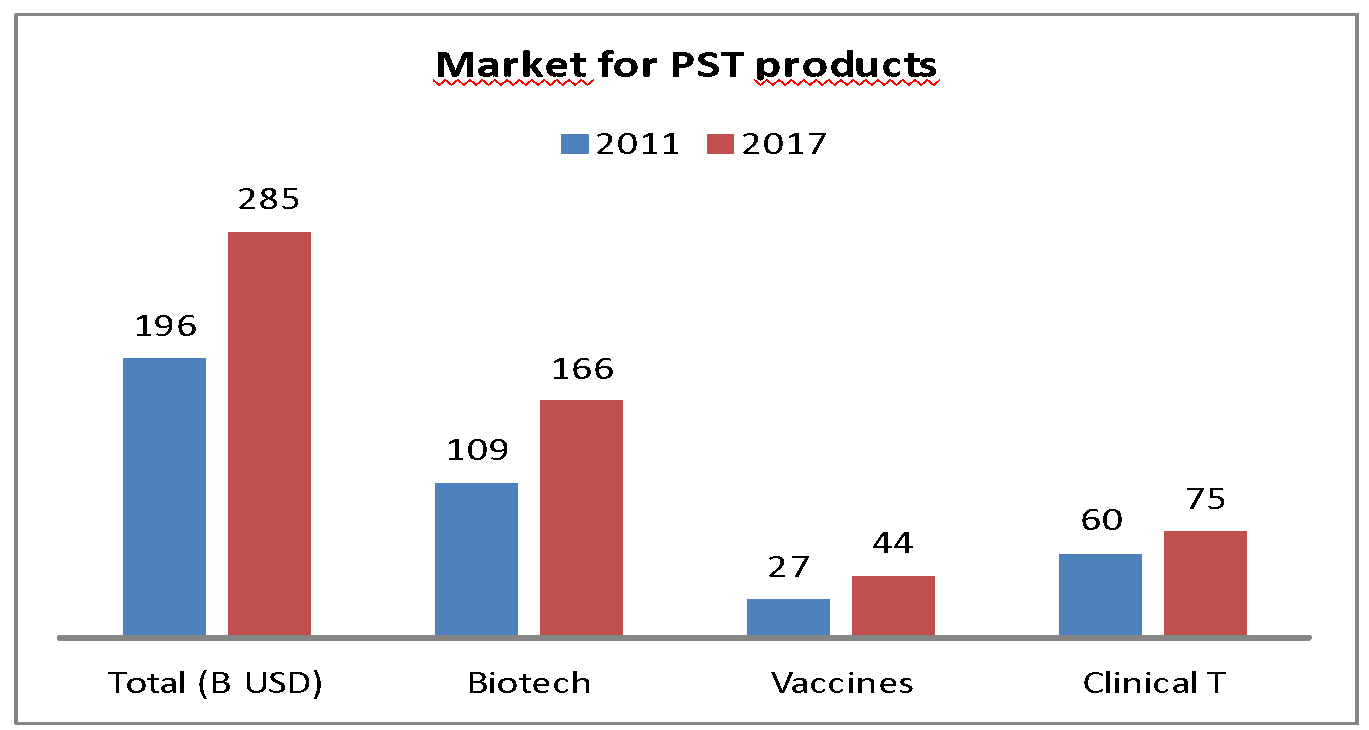

Consequently, from 2011 to 2017, the number of heat-sensitive healthcare products increased by 45%: 1 out of 2 medicines on the market is heat-sensitive.

Market development of heat-sensitive pharmaceutical products in 2011 and 2017.

Stricter regulations impacting cold chain logistics

Marie Boned, Quality Distribution Manager & Pharmacist within the Septodont laboratory, talks to us about the tightening up of regulations with regard to the cold chain logistics of healthcare products:

“The publication in 2012 of the new GDP (Good Distribution Practices of medicines) is not without consequences for temperature-controlled logistics. It requires the implementation of devices ensuring the temperature control of healthcare products and medicines stored at +15/+25°C. The logistics of heat-sensitive products is becoming a real headache for laboratories, which combine the financial-security-regulatory aspect with increasingly larger volumes.

Simultaneously, laboratories are subject to the ISO14001 standard which is based on the continuous improvement of environmental efficiency. The laboratory must act to minimize the damaging effects of its activities on the environment.”

An inevitable growth of cold chain logistics, but with new constraints

Thus, the development of biotechs, combined with the increase of illnesses requiring heat-sensitive treatments and the tightening up of regulations, has resulted in a clear market increase of cold chain logistics for medicines and other healthcare products in volume.

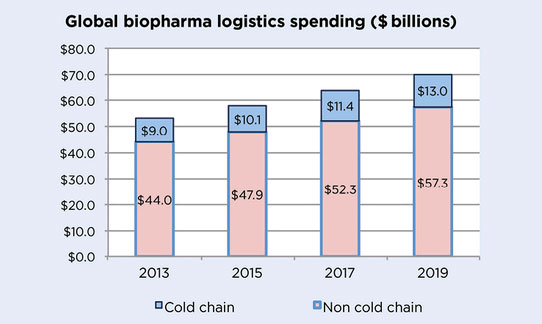

The market for temperature-controlled logistics for healthcare products could reach 13 billion dollars in 2019, i.e. a 40% increase compared with 2013, resulting in an average of a 14% cost increase for medicine companies in their cold chain management expenditure compared with 2017.

Forecasts of global spending for the biopharmaceutical sector in cold chain logistics for 2019.

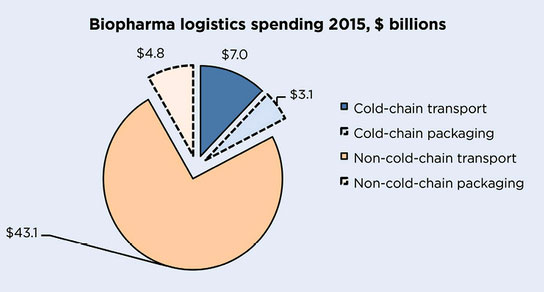

Biopharma sector 2015 global spending in temperature-controlled logistics of medicines

A growing awareness among laboratories: transporting temperature-controlled products requires specific equipment (insulated packaging solutions, temperature recorders, cold chambers, refrigerated vehicles, etc.) which makes the logistics expensive, with risks and a potential real environmental impact.

In fact, the implementation of cold chain logistics is far from simple. It is necessary to simultaneously bring together risk management, cost control, patient safety and regulatory compliance.

So, how to minimize logistical costs while maintaining temperature security? Two popular responses include: the circular economy (for air or road transport), or switching to sea (for air transport). In the following articles, we will expand on these topics of cost reduction and the environmental impact of cold chain logistics.